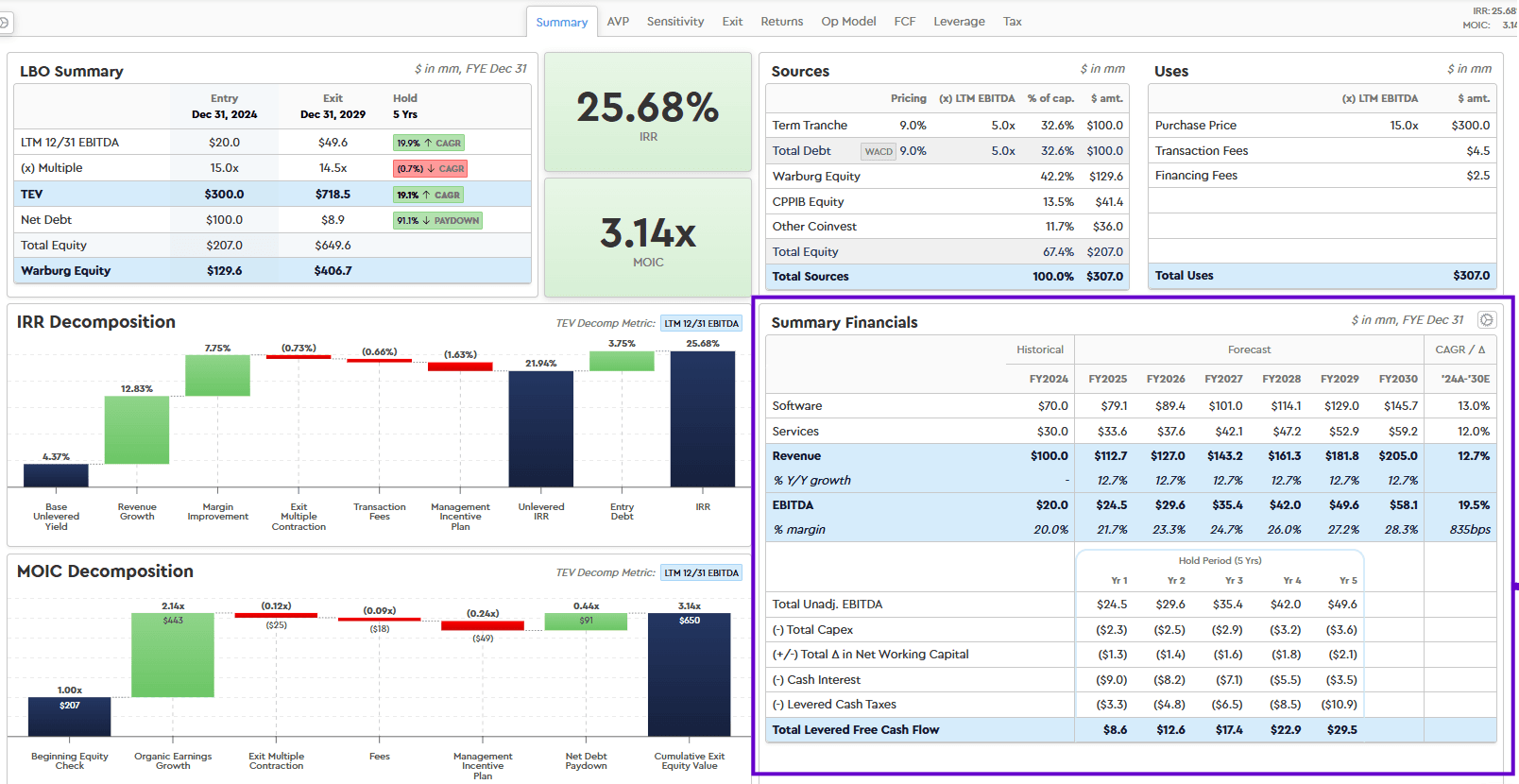

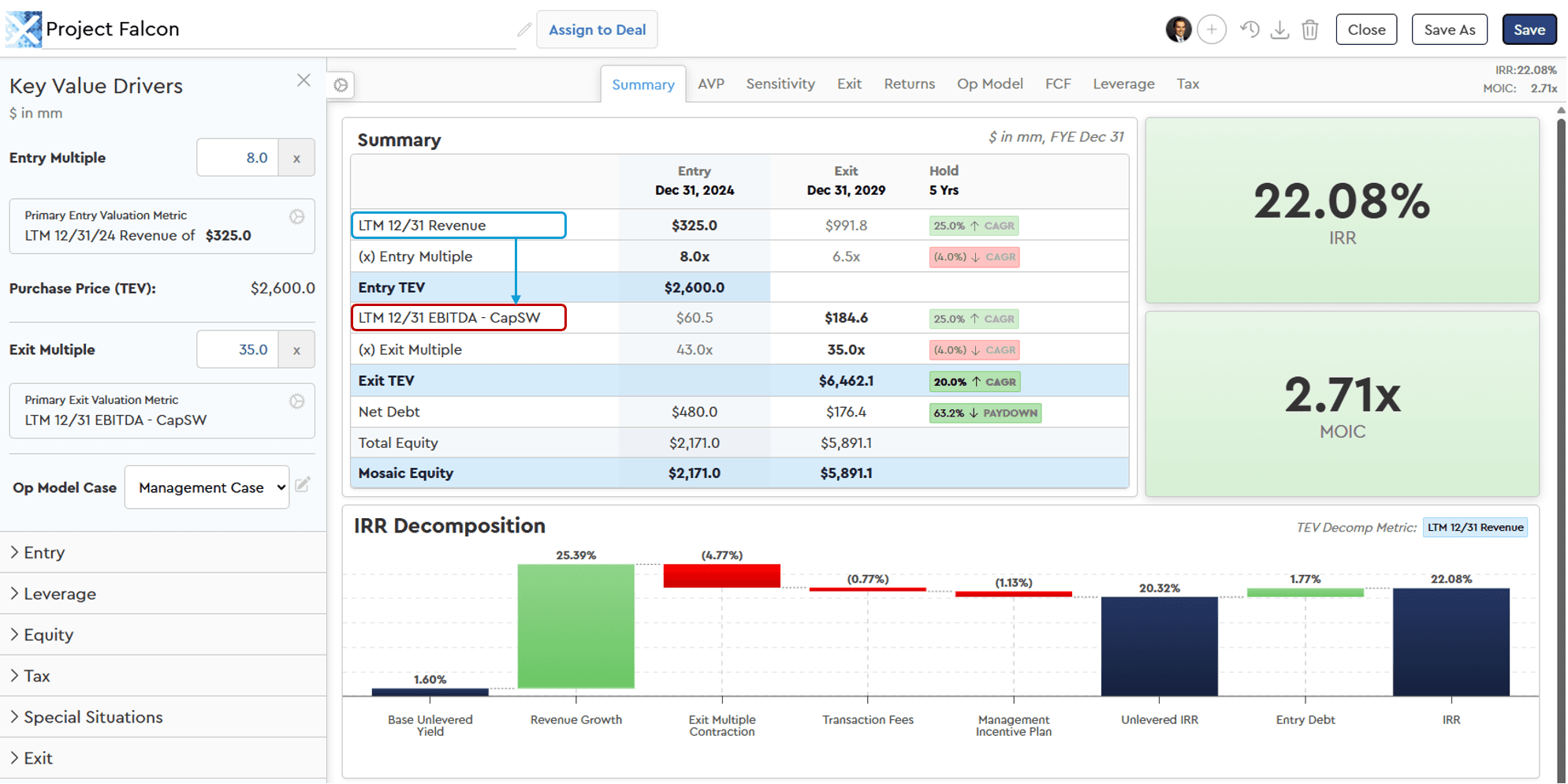

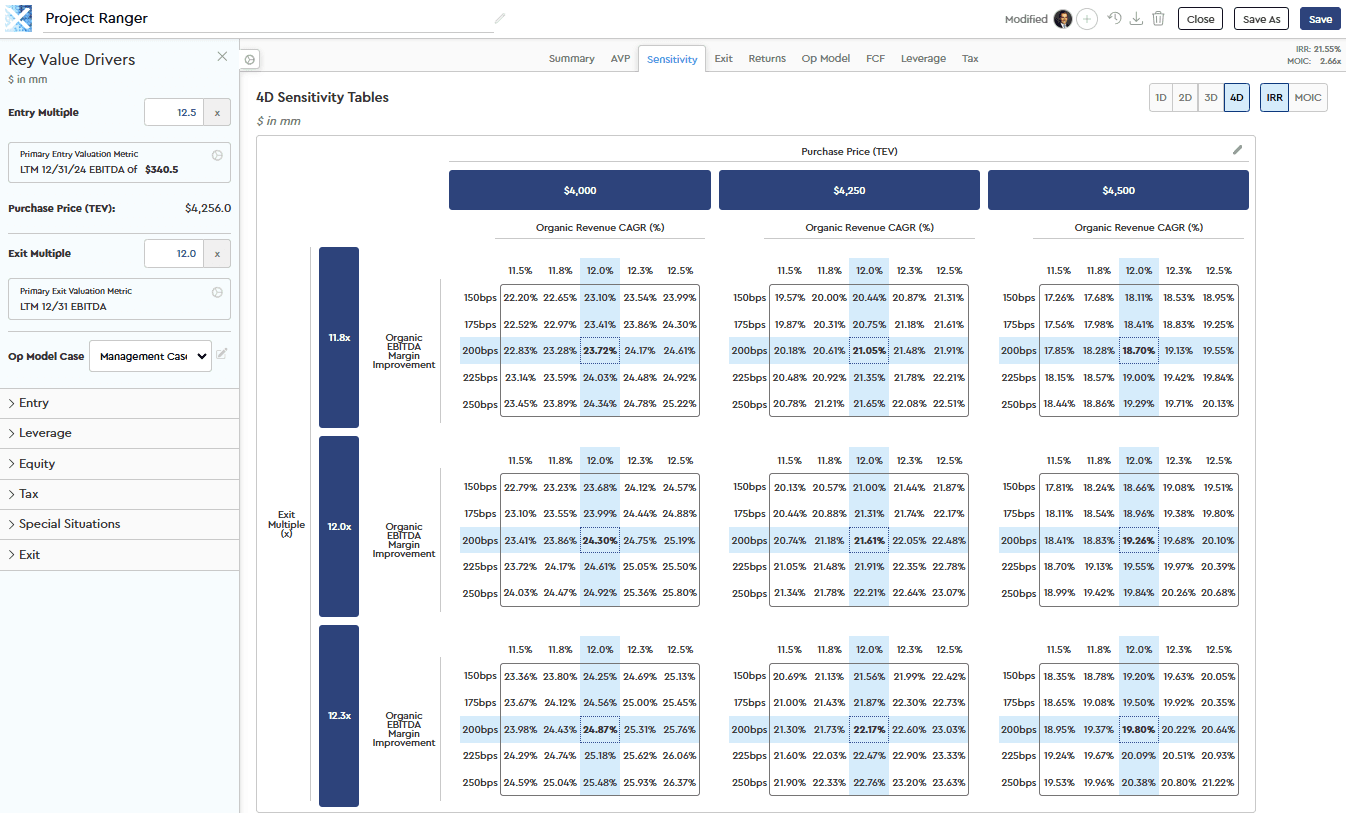

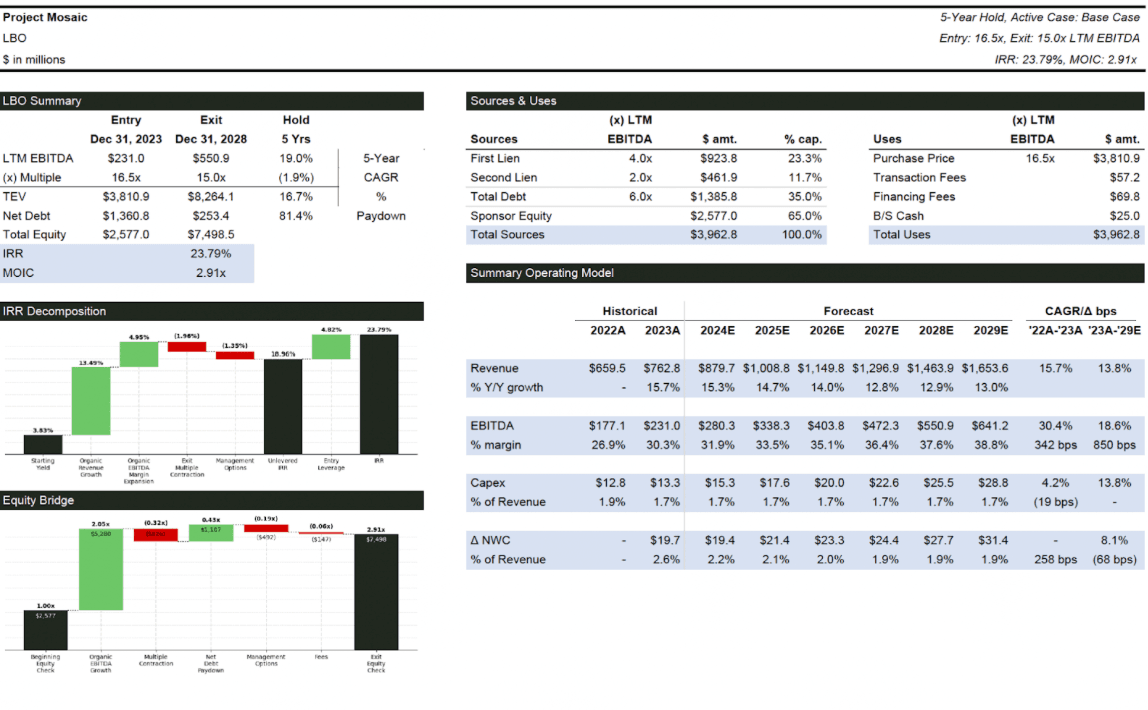

Introducing Mosaic Autopilot - The World's First Agentic Deal Modeling Workflow

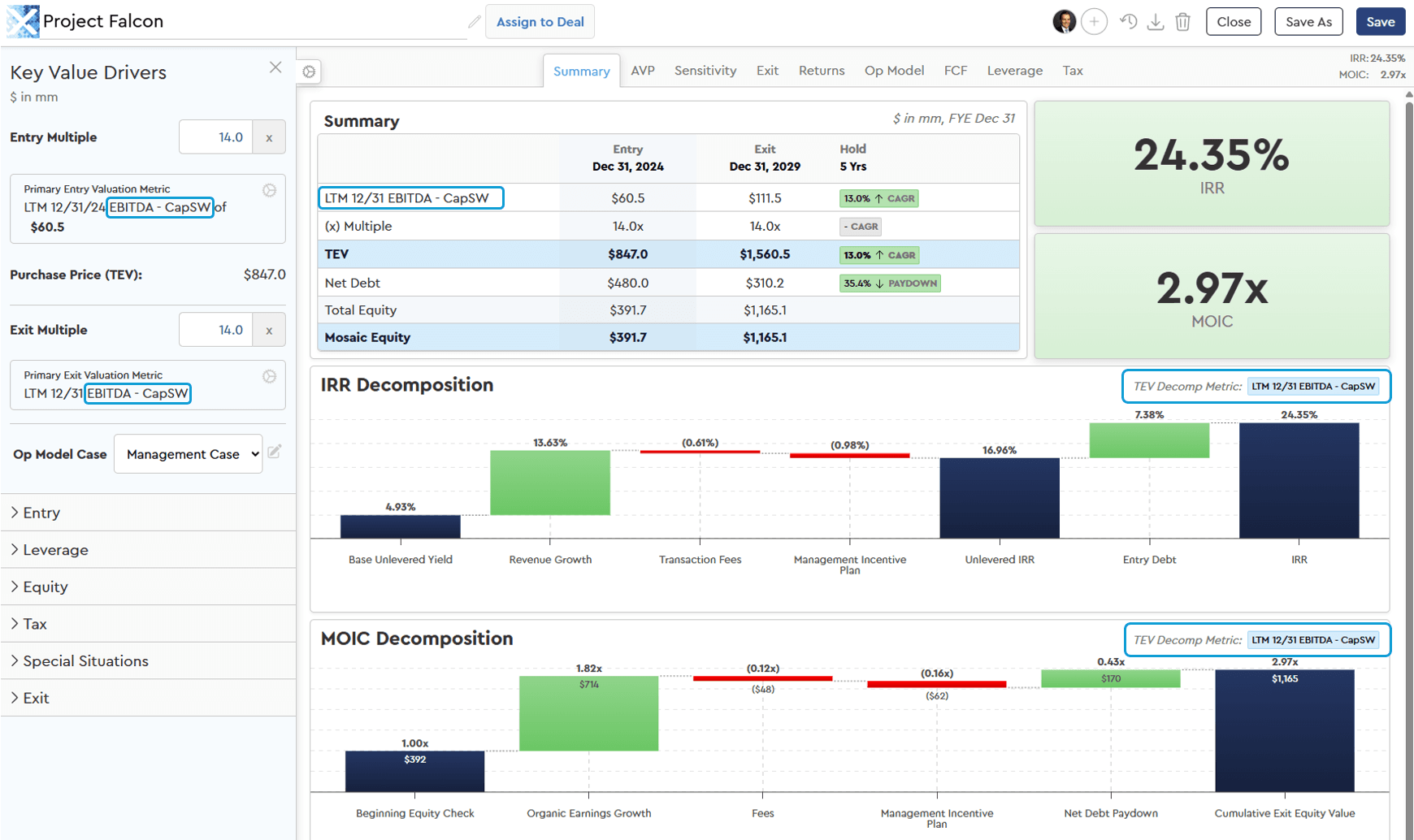

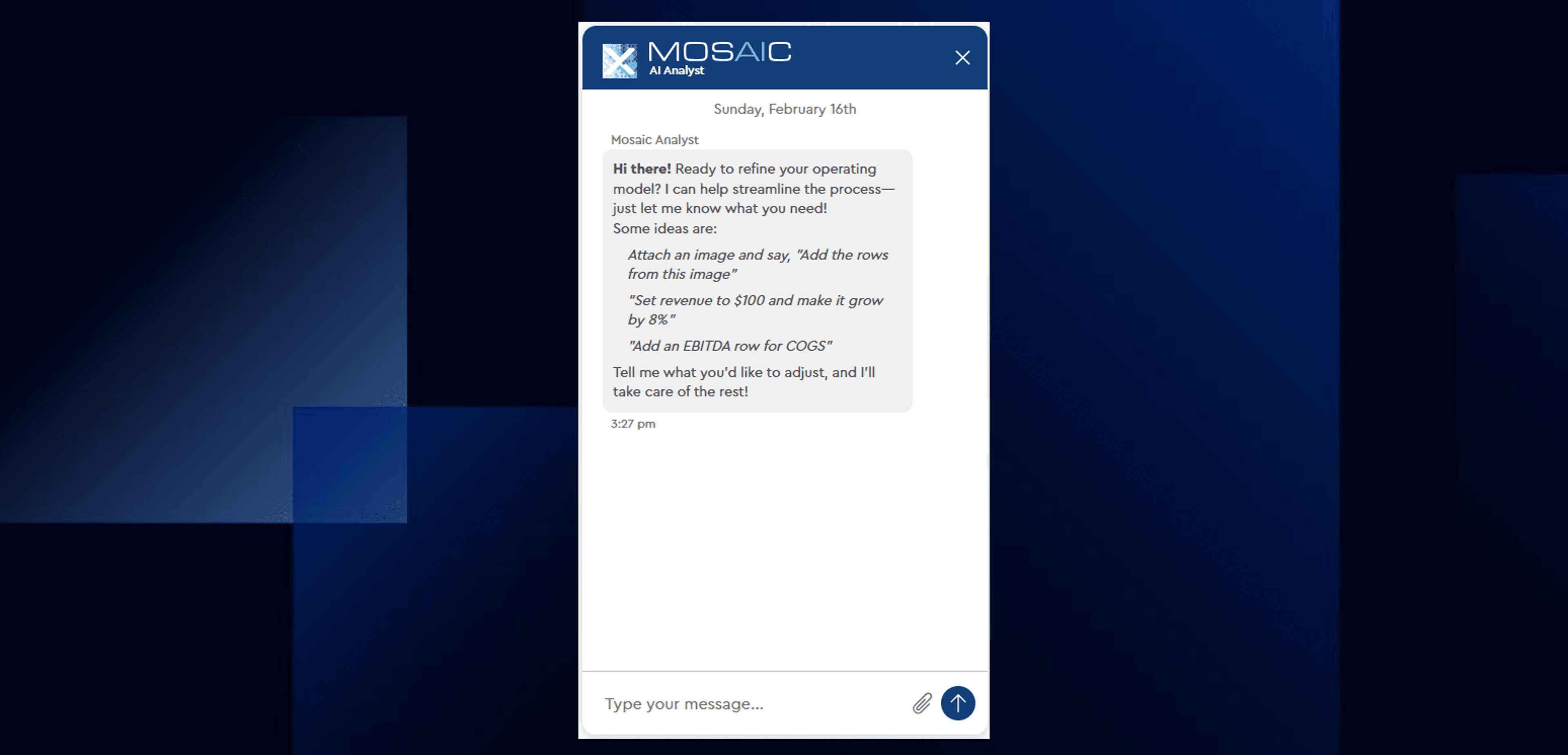

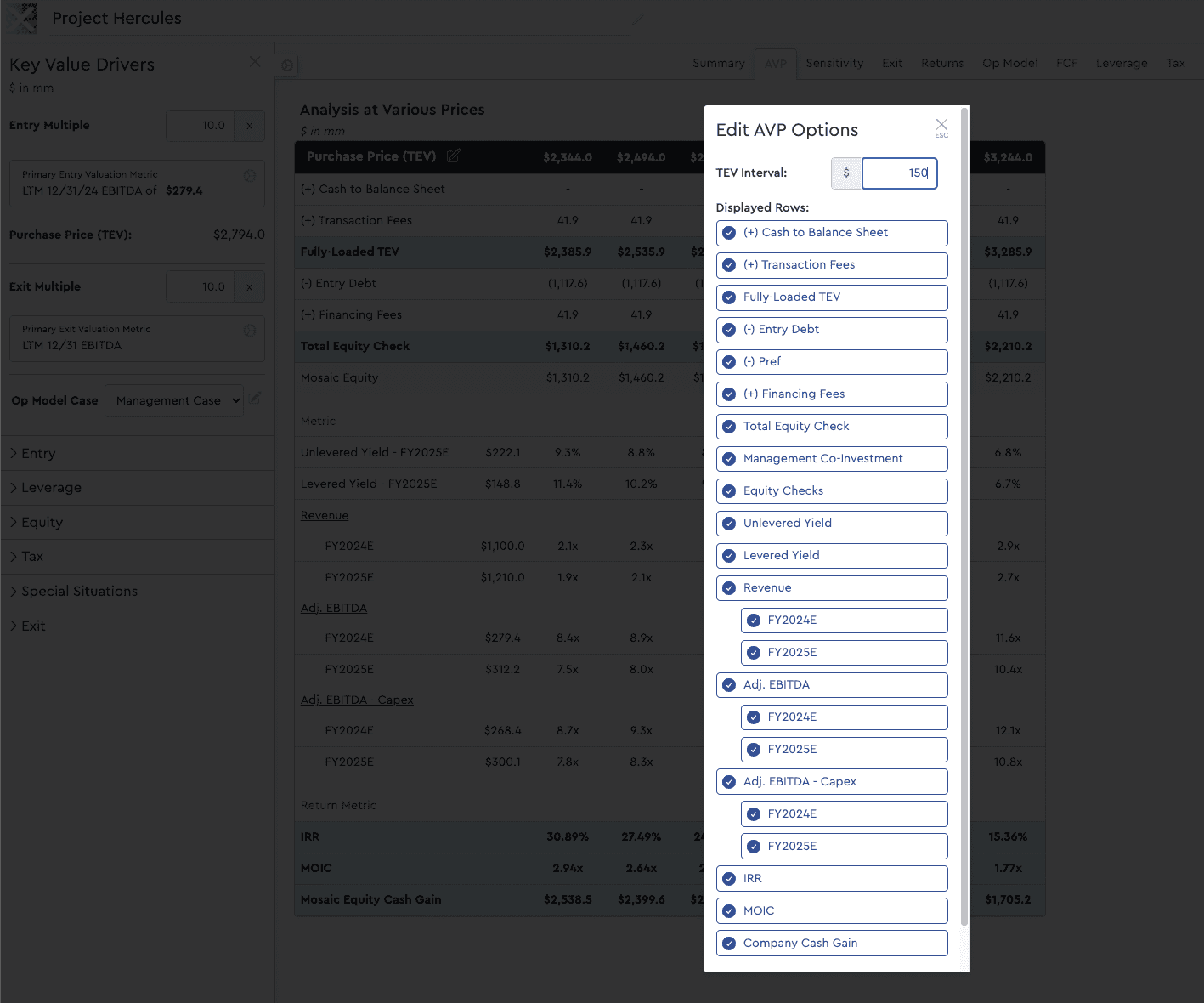

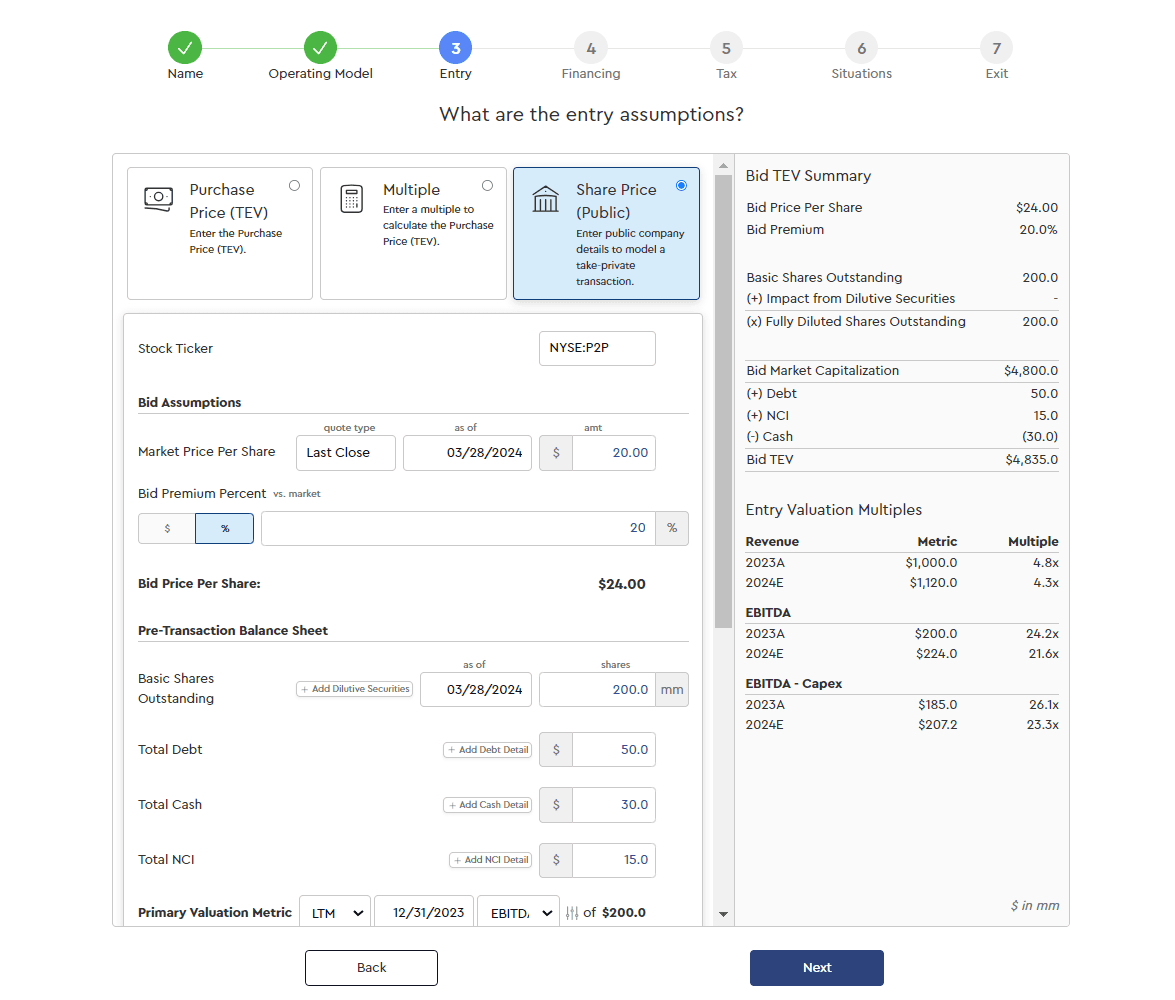

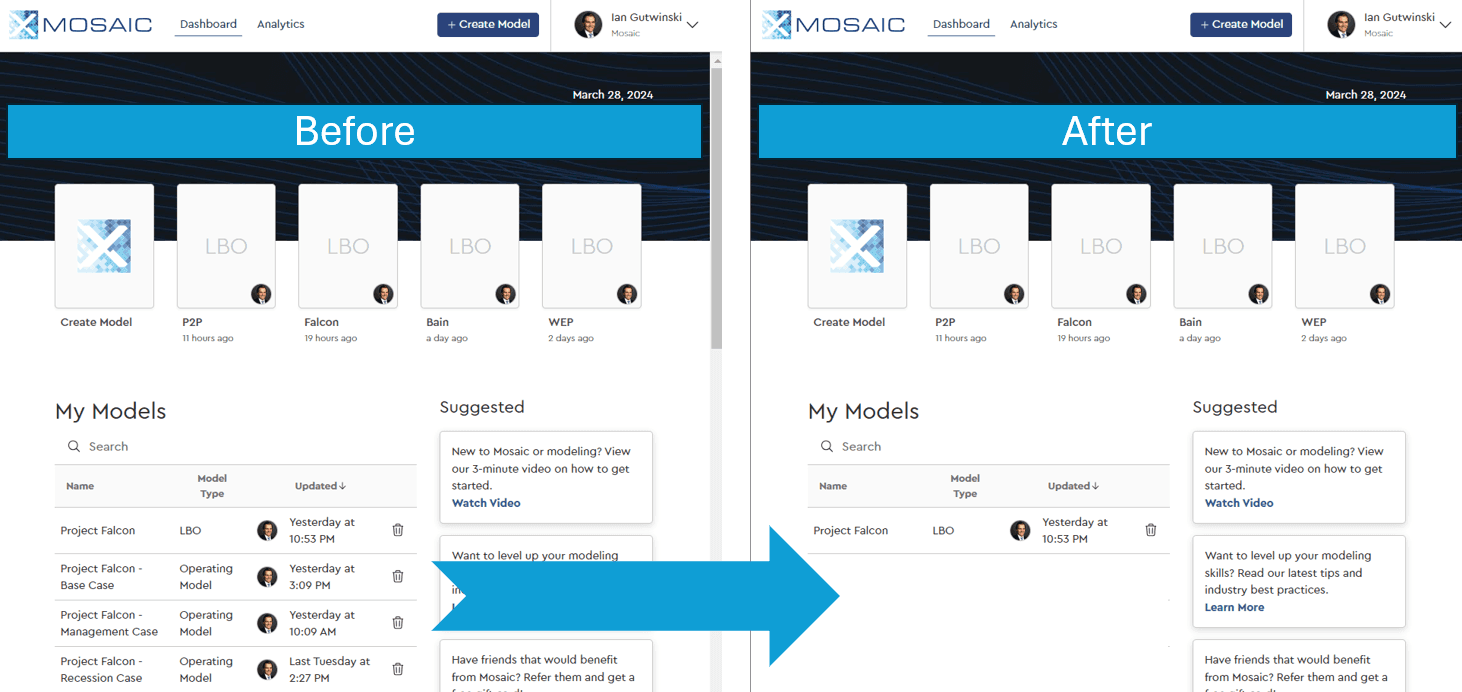

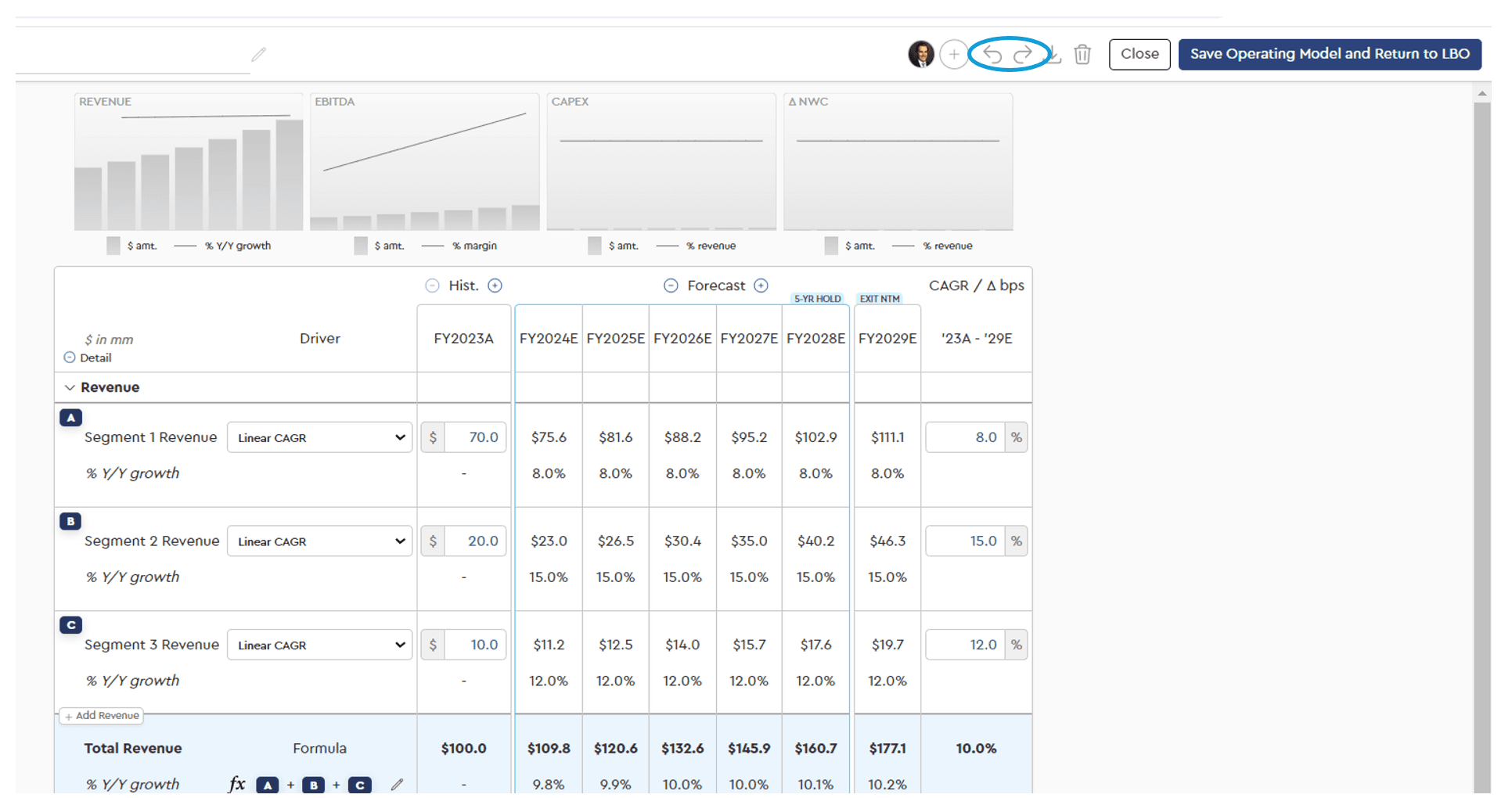

Autopilot for Mosaic is here — a completely reimagined workflow for deal modeling and analysis.

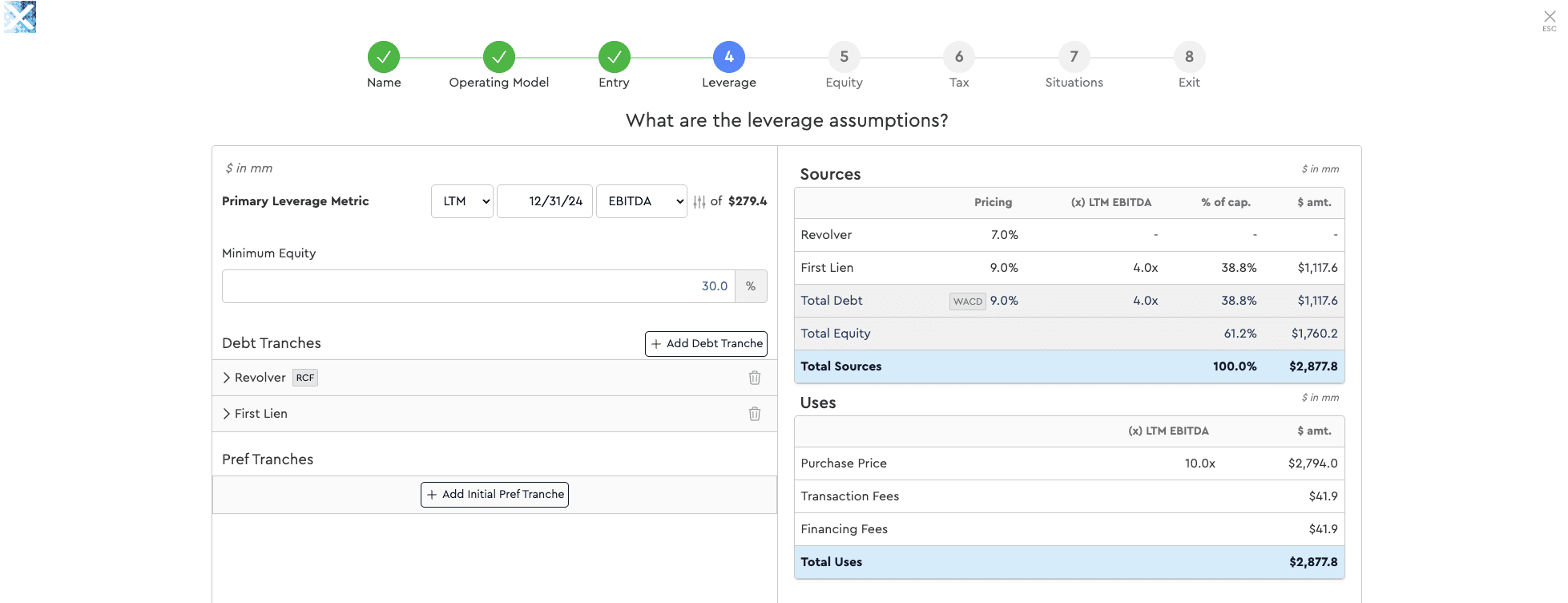

With Autopilot, you can now go from CIM to MD-ready model in minutes. Simply email your materials (CIMs, investor decks, or management presentations) to model@mosaic.pe with the same instructions you’d give an Associate.

Within five minutes, you’ll receive:

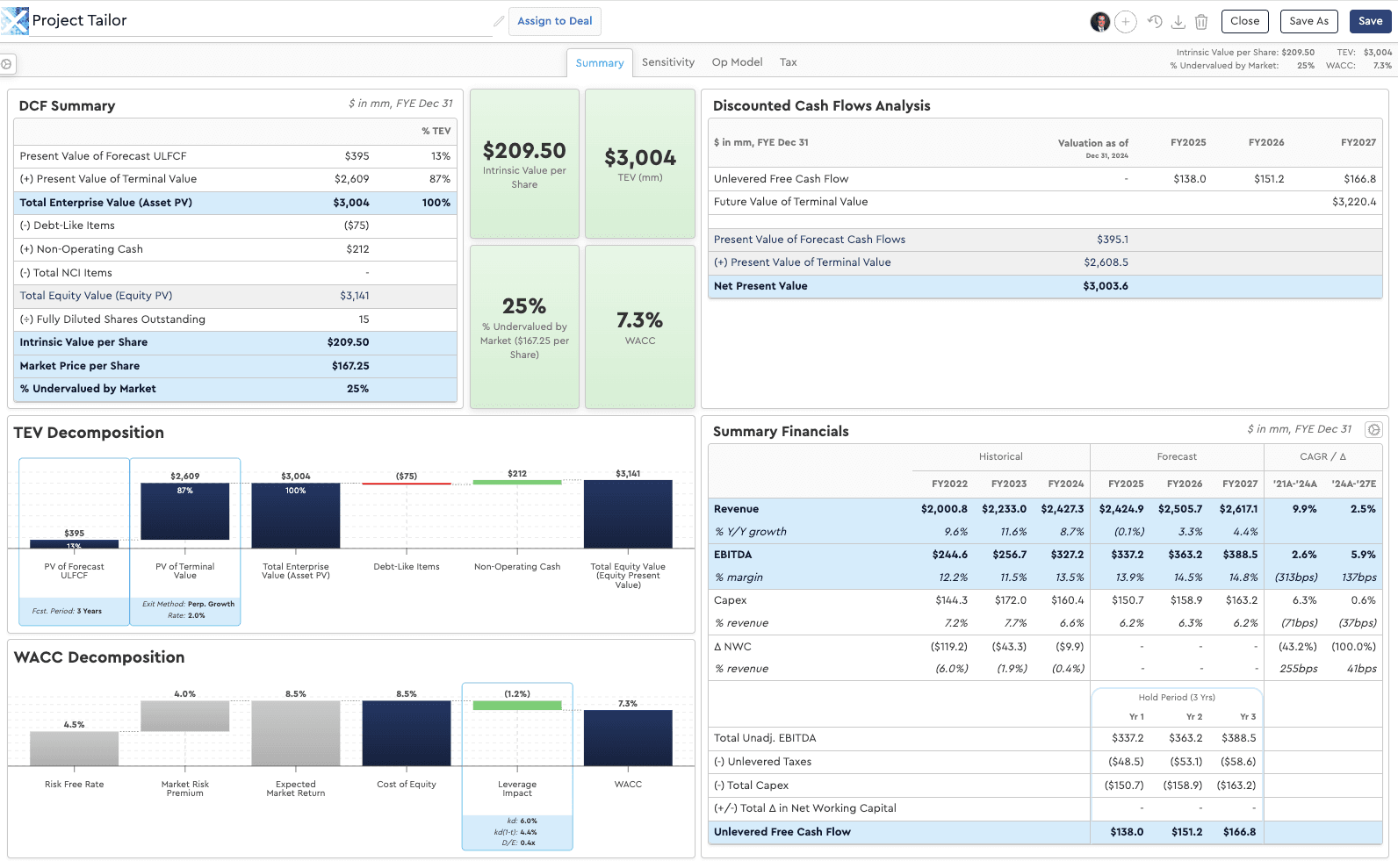

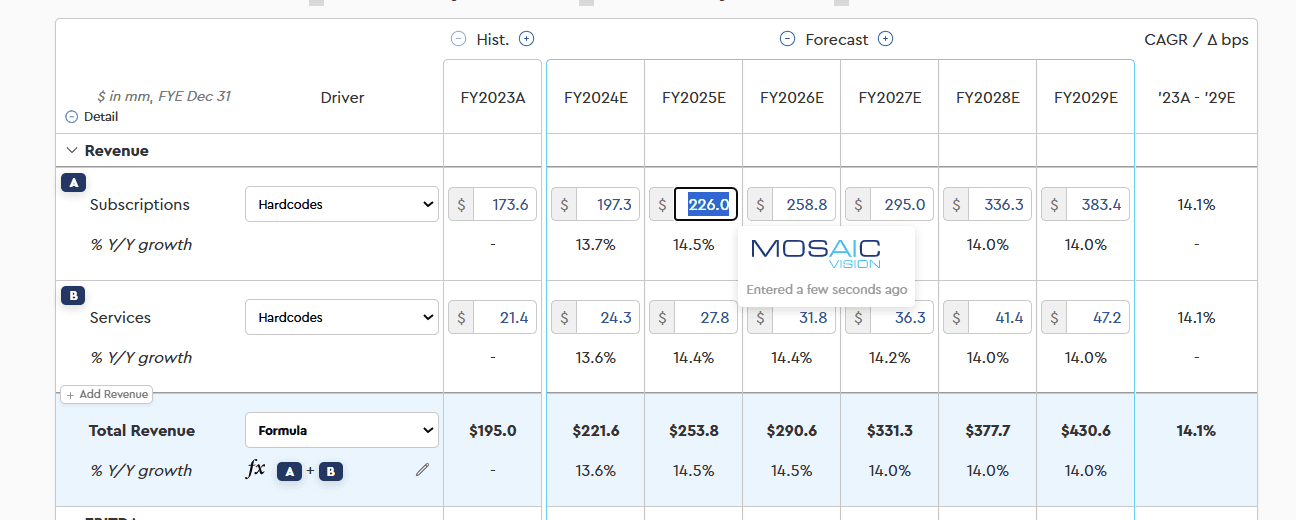

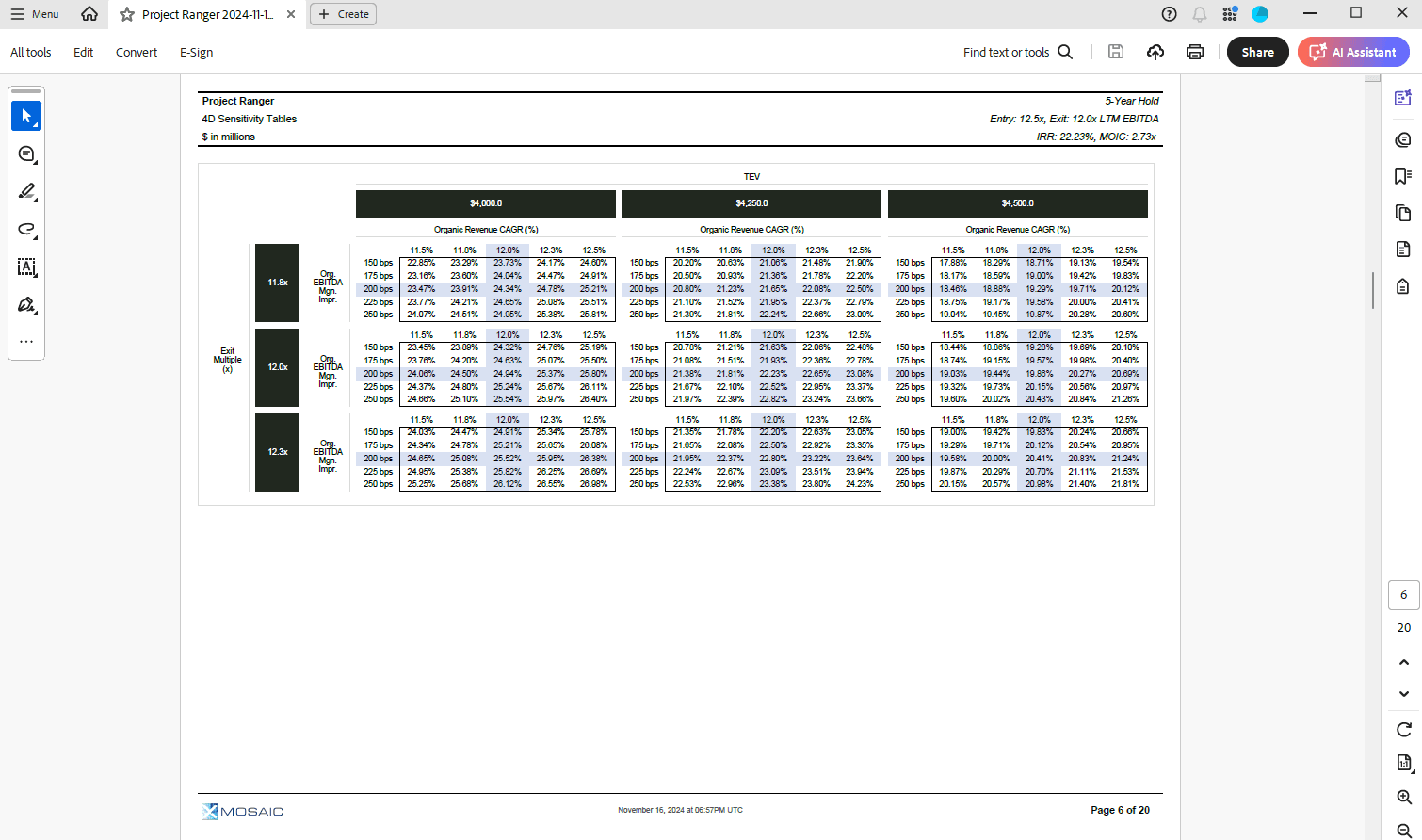

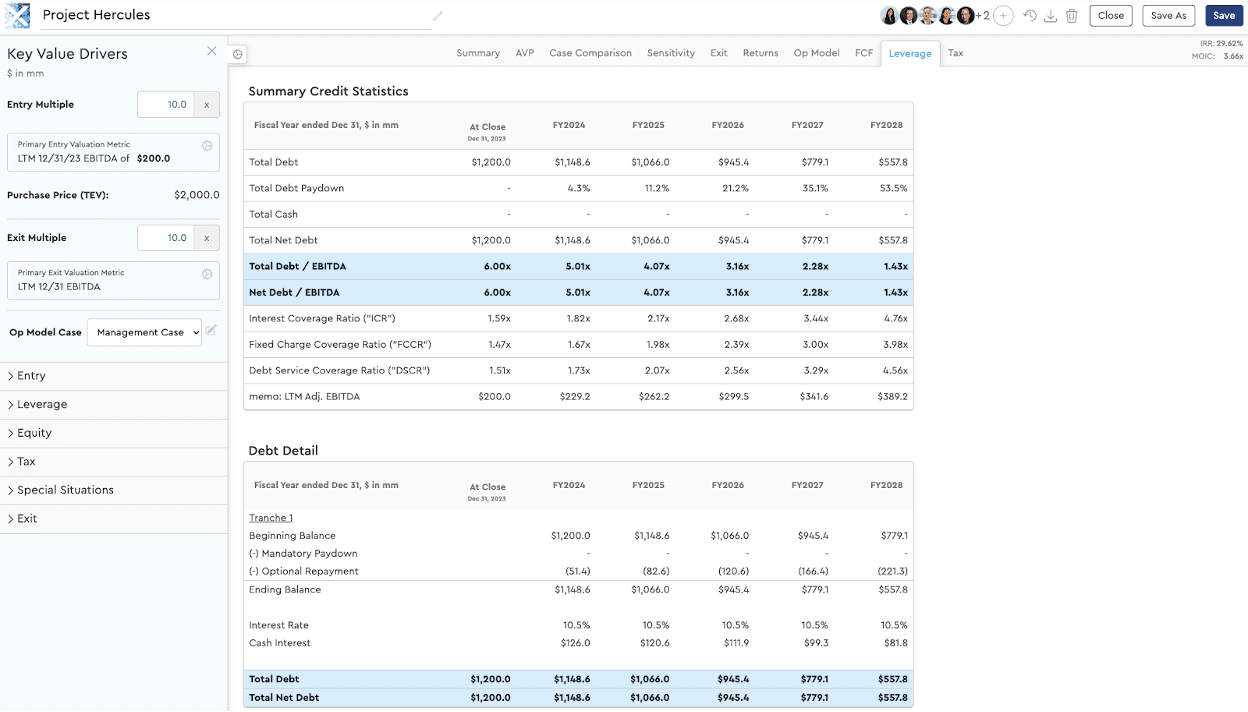

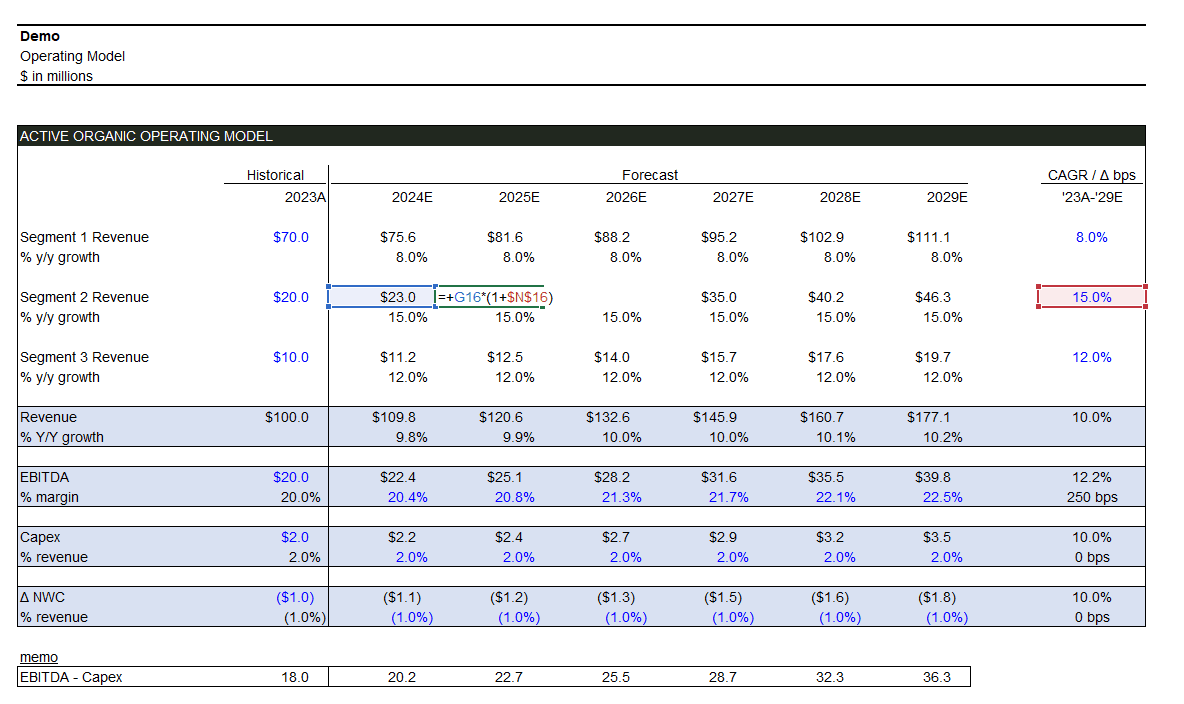

A fully built Mosaic model, ready for review and export

A summary of insights and key assumptions our agent made

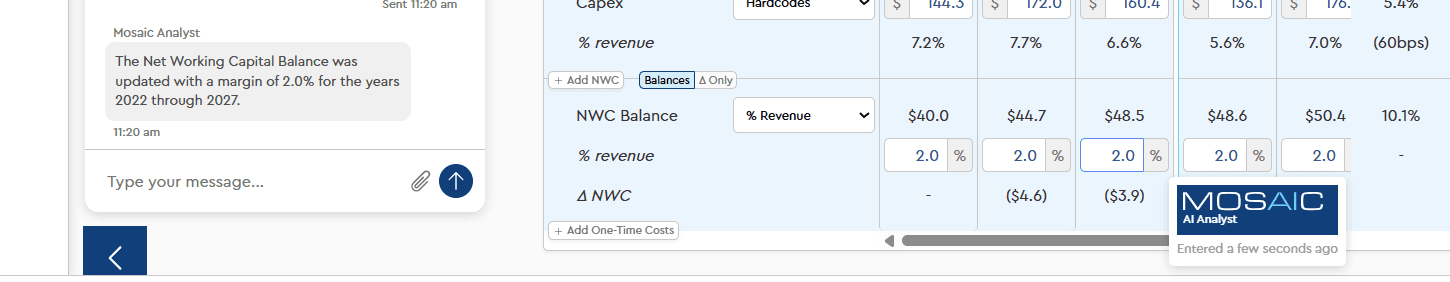

Need revisions? Just reply to the email. Mosaic refines the model automatically — just like collaborating with your human deal team.

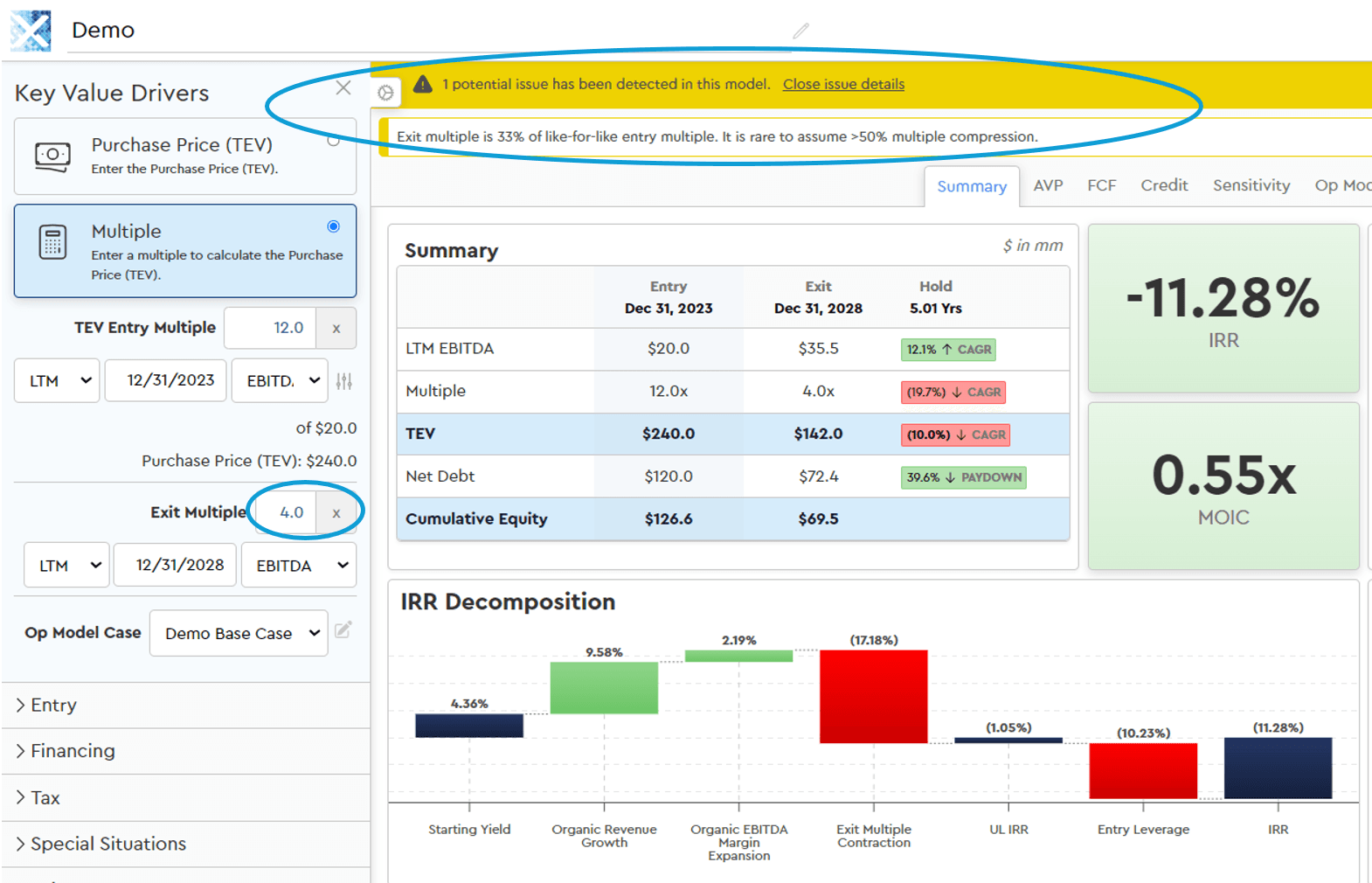

Deterministic Accuracy — Not Another Co-Pilot

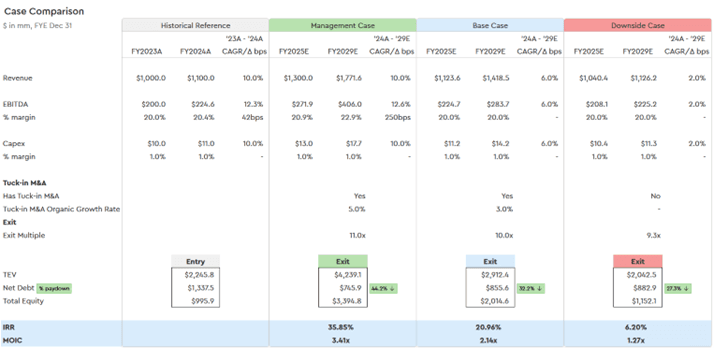

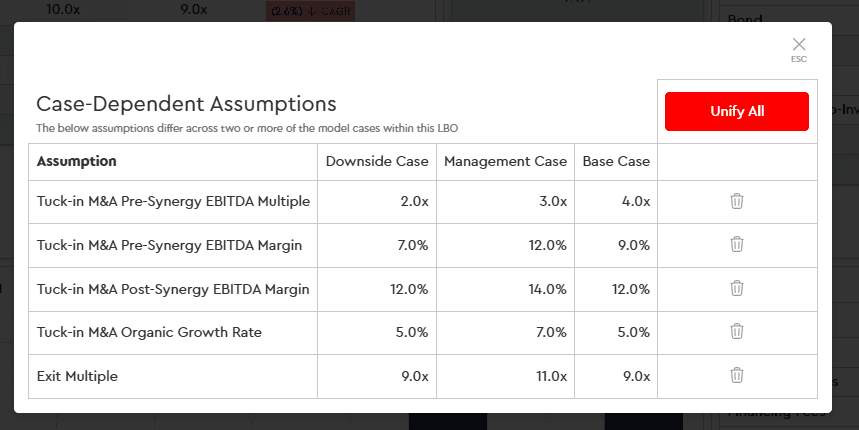

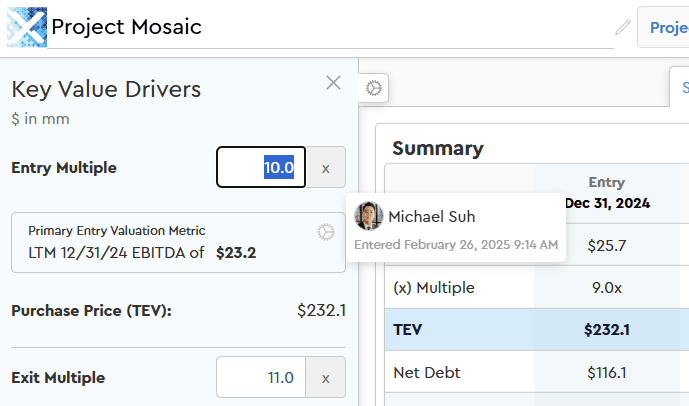

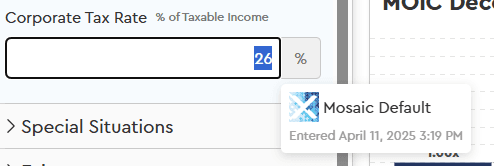

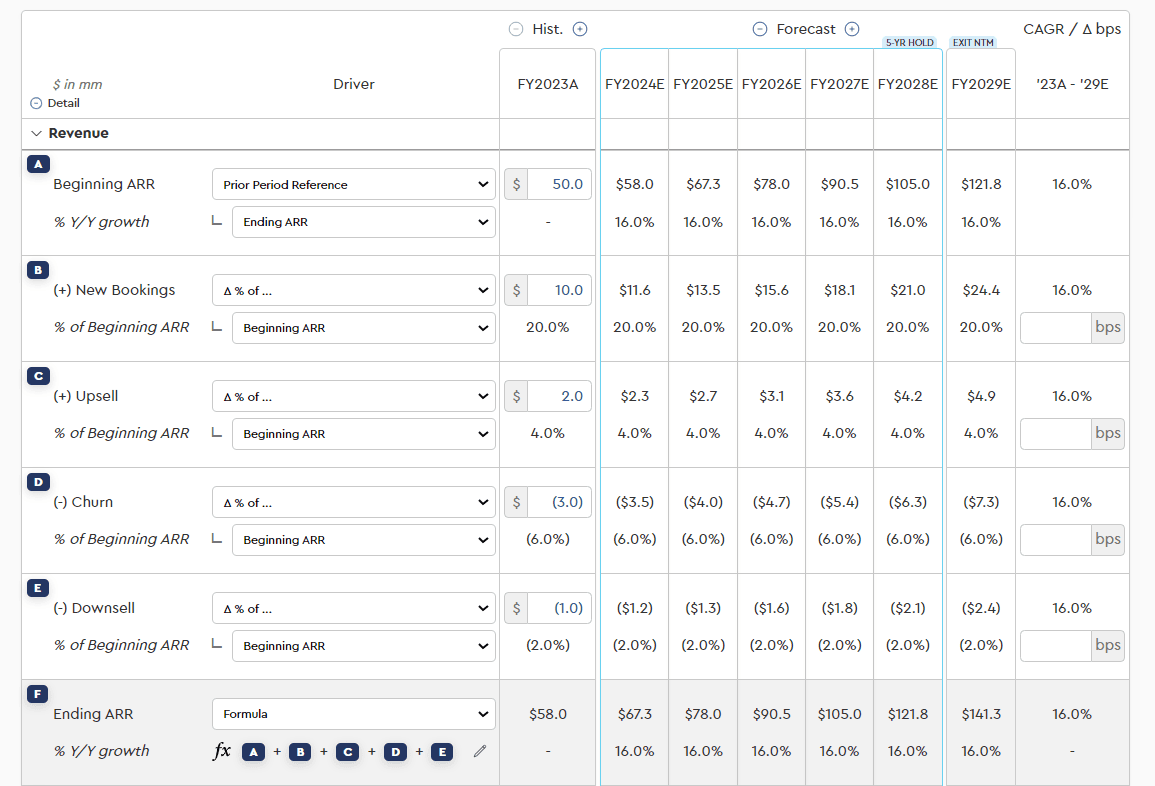

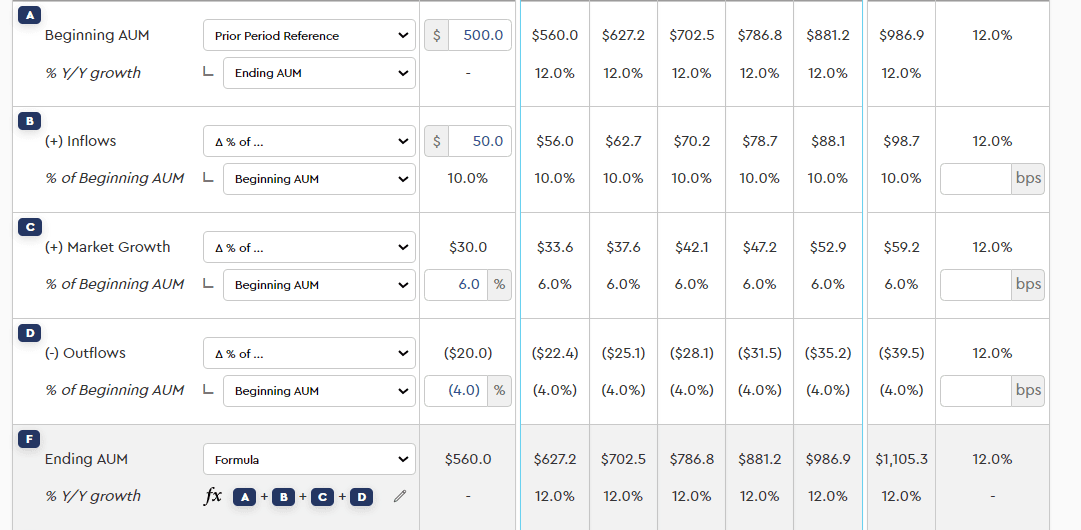

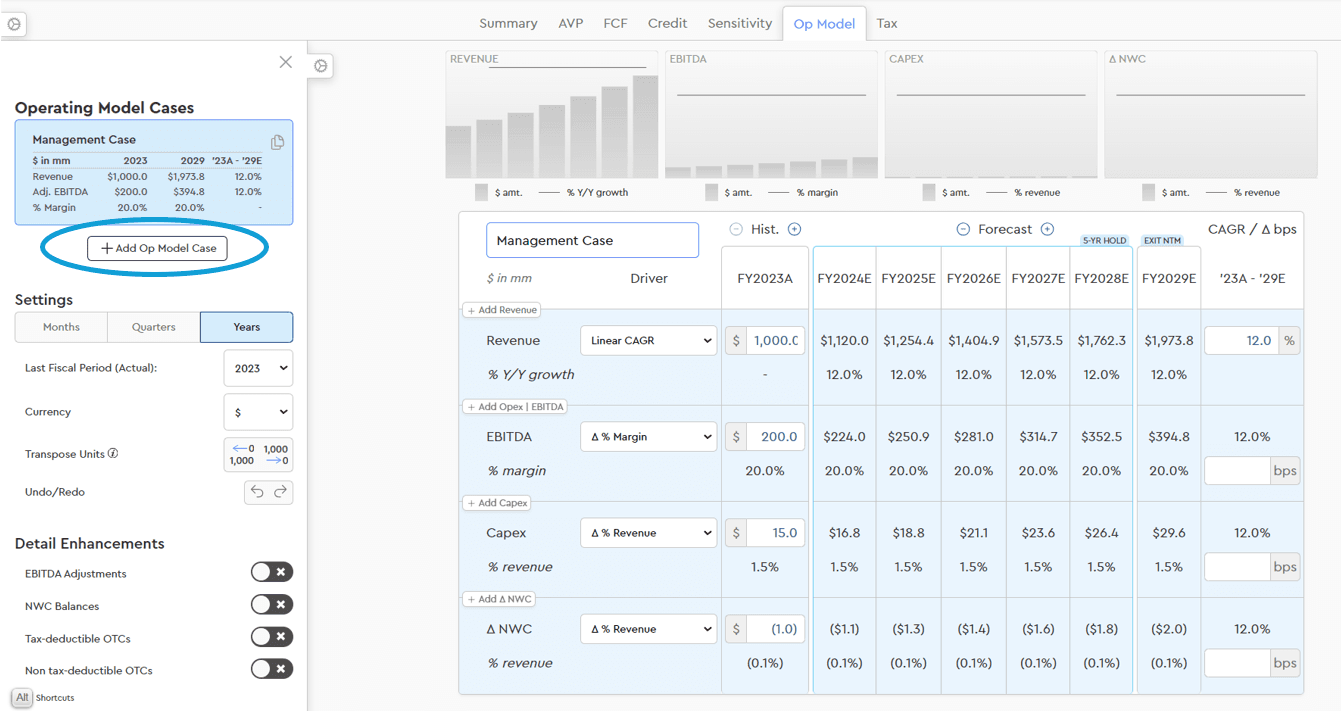

Autopilot isn’t an Excel add-on. Mosaic’s deterministic calculation engine means:

No hallucinations — every number is grounded in real math

No surprises — every calculation is transparent and auditable

Perfect accuracy — every model is bid-ready

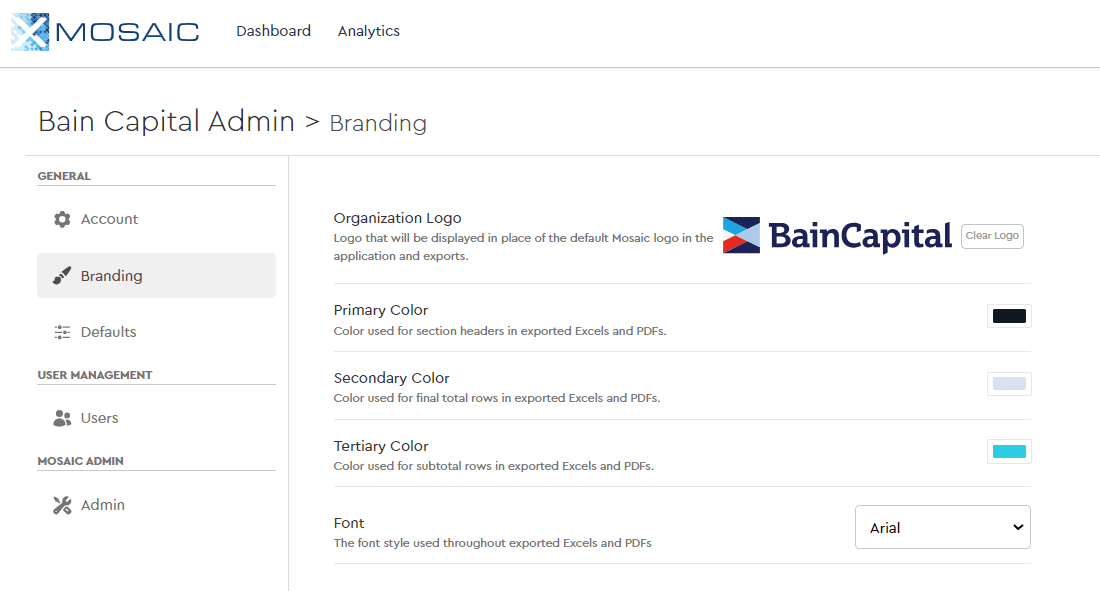

You can download the model to Excel with linked formulas for full transparency, or export MD-ready PDFs in your firm’s template.

Human Judgment Still Matters

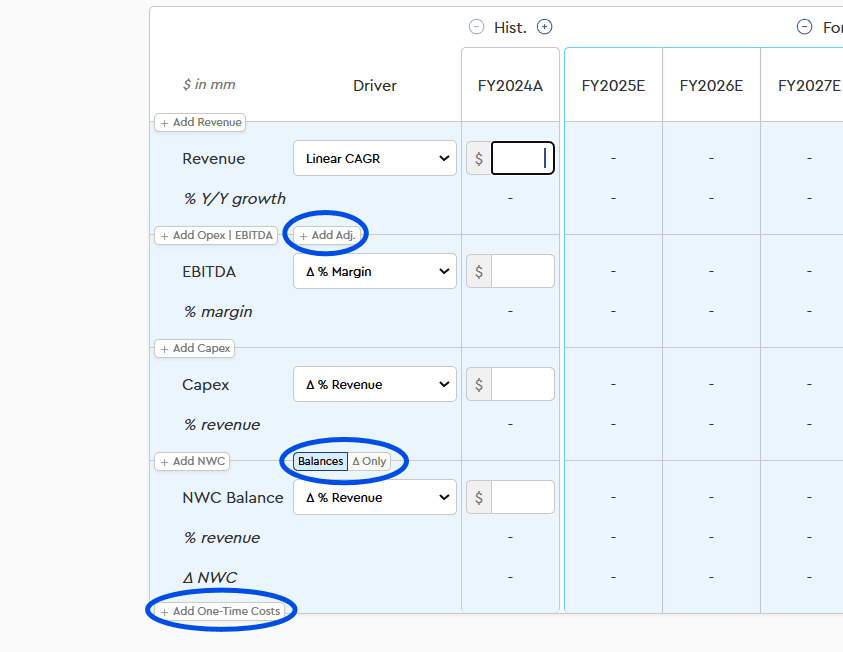

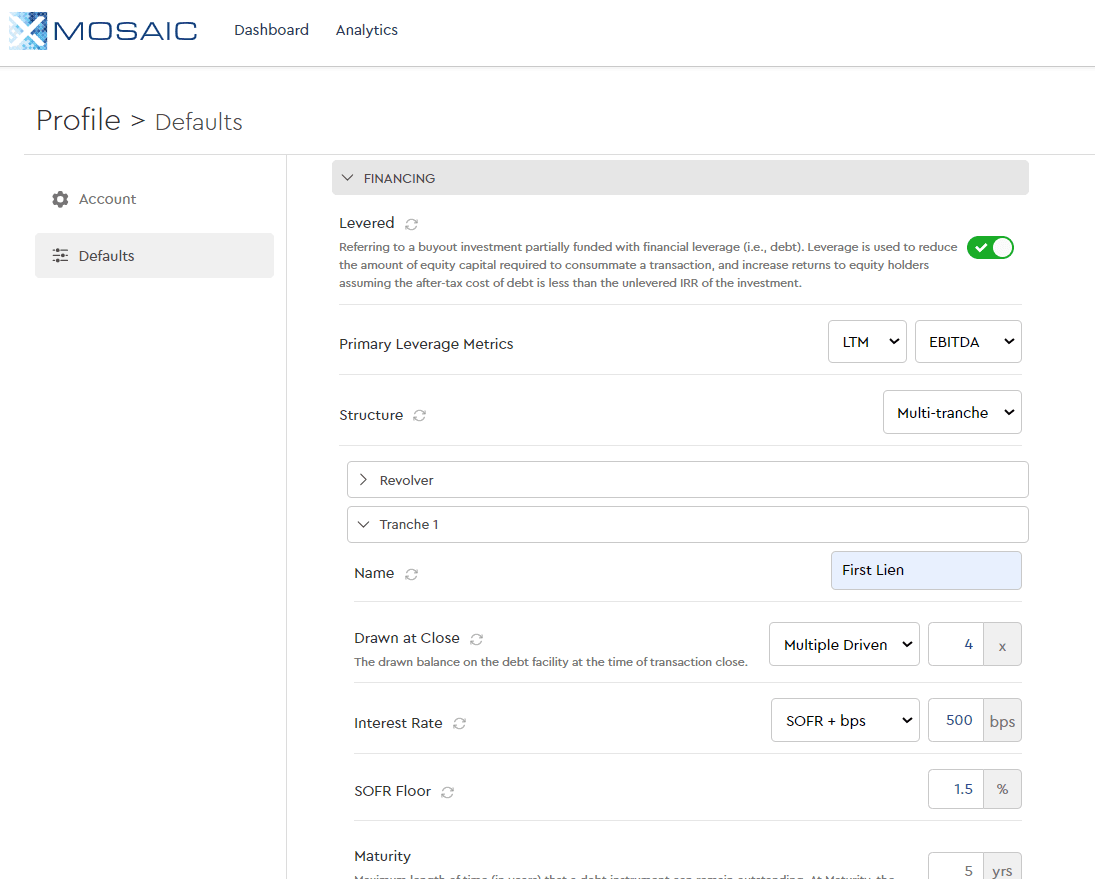

Autopilot can be switched off anytime. “Hand-fly” Mosaic, enter your own assumptions, collaborate across your deal team, and apply the investment judgment that makes dealmaking human.

Because AI should accelerate your analysis — not replace your insight.

Send your next CIM to model@mosaic.pe. The future of deal analysis is here.